How to Qualify for Energy Efficiency Tax Credits

Inspire Clean Energy

12 min read

category: Sustainable Living

Don't worry about climate change— do something about it.

Our clean energy plans are the easiest way to reduce your home's carbon footprint.

Switch to clean energyUpgrading your home energy solutions could help you to slowly reduce your monthly energy bills over time as well as improving energy-efficiency, which is a great way to be kind to the environment and help in the fight against climate change.

However, making energy-efficient home improvements is a very expensive venture, which is why many people feel that they can’t do anything to change their home for the better. Whatever type of efficient energy you are looking to improve your home with, there are energy tax credits available to you that can make these environmentally friendly upgrades much more affordable.

Also, don’t worry if you find that most of these home improvements are out of your price range at this moment. We can help you switch to clean energy in just 5 minutes.

Energy-Efficient Home Improvements

So, what steps can you take to make your home environmentally-friendly and energy-efficient?

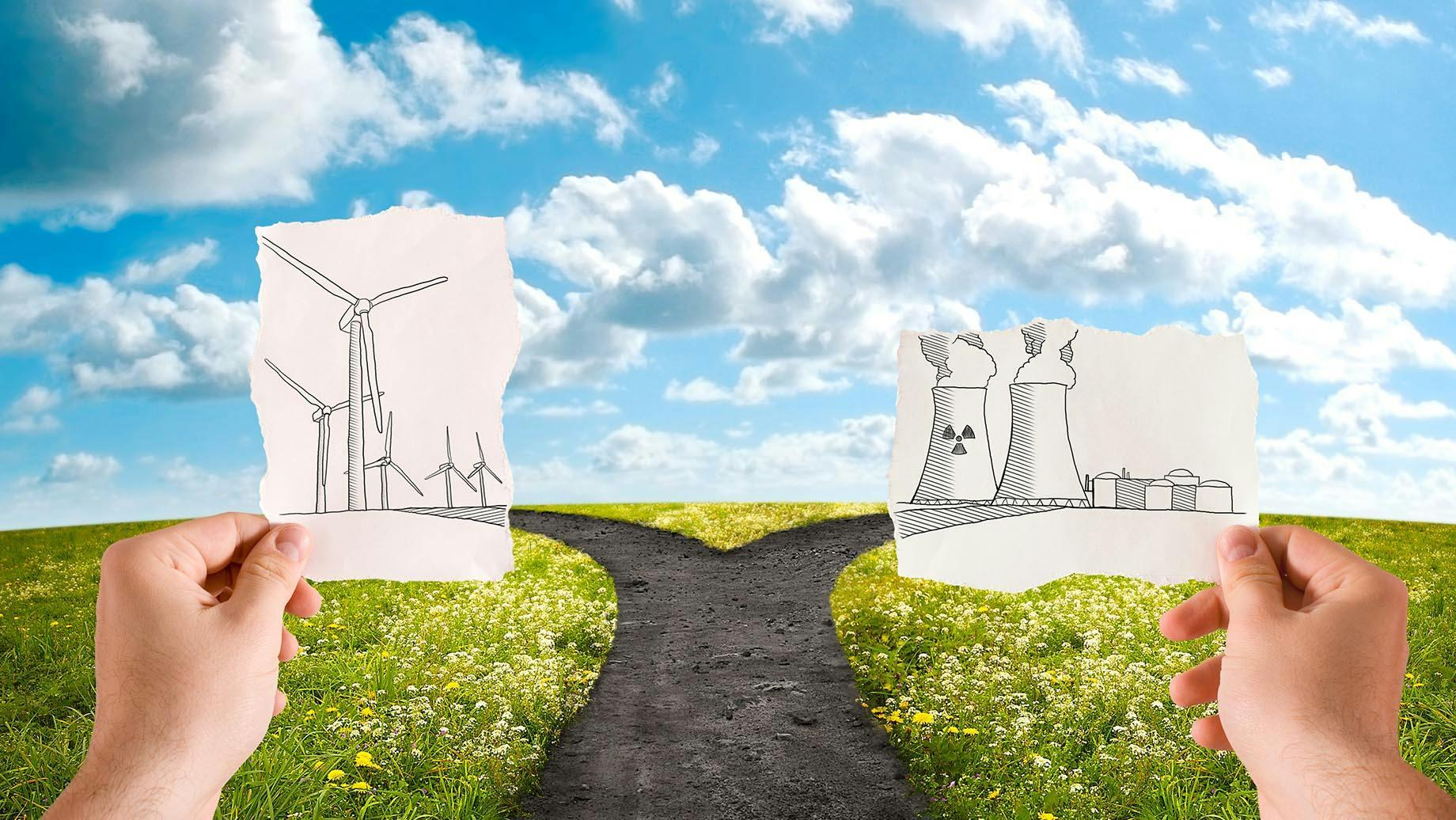

Switch to a Renewable Energy Provider

The first step towards an energy-efficient home is to switch to a renewable energy company like us. Instead of using those harmful fossil fuels to provide energy to your home, we provide you with clean energy from renewable sources.

When you take this first step, everything else you do will have serious benefits on the environment and the price of your energy bills. Make the switch to clean energy today to start helping heal the environment one step at a time.

Although switching to Inspire by itself does not get you a tax credit, you can pair your new unlimited clean energy plan with any of the upgrades below that do qualify:

Biomass Stoves Biomass stoves create heat from the combustion of organic materials, typically compressed wood or biomass pellets. This organic material burns cleanly for an affordable, efficient, and environmentally friendly source of heat. Of course, you should be aware that you are still burning materials, and so there will be some waste being produced.

When you switch to a biomass stove, you can get a maximum energy efficiency credit of $300.

Advanced Main Air Circulating Fans Advanced main air circulating fans are an efficient way of producing heat for your home through a fan or blower motor blowing air into your furnace to be heated up and fed into your duct system. Again, the fuel used for your furnace and how energy efficient it is will make a big difference in how clean and energy-efficient this form of heating is for you.

Advanced main air circulating fans qualify for a maximum credit of $50 – so there are generally better options.

Air Source Heat Pumps Air source heat pumps are systems that use electricity to take heat from outside and bring it into your home for warmth and hot water. This is a great choice because it uses electricity, so is energy-efficient and clean.

Since this is such a great source of heat, air-source heat pumps have a maximum credit of $300.

Central Air Conditioning Most of us have some form of air conditioning in our homes, but many aren’t working optimally. To keep your air conditioning working cleanly, use energy from clean sources, change air conditioning filters clean, get the whole system cleaned regularly, and only run it when necessary.

If your system is old, upgrading will help you not only get a better quality of air but cut down your energy consumption, too. When you upgrade, you can qualify for a maximum credit of $300.

Gas Boilers Gas boilers work to heat water to provide your home with hot water and heating, using natural gas and aren’t an eco-friendly choice because they rely on natural gas, which must be extracted from beneath the earth’s crust.

However, you can receive a maximum energy credit of $150.

Gas Furnaces Gas furnaces also use natural gas, but they work to heat your home by heating air and distributing that hot air through your ducts. As previously noted, this isn’t an environmentally friendly option, so we wouldn’t recommend it. However, you can qualify for an energy credit of up to $150.

Gas Heat Pump Water Heaters Rather than directly generating heat, a gas heat pump water heater moves heat from one place to another. This heating system is typically 2 or 3 times more energy-efficient than traditional water heaters.

Again, this isn’t the best choice because it relies on gas. You can find electric heat pump water heaters, however, which would be the best choice. Any of these energy-efficient heat pump water heaters qualify for a maximum energy credit of $300.

Electric Heat Pump Water Heaters As we talked about above, these work in the same way as gas heat pump water heaters, except electricity is used to power the pump. This is by far the best way to heat your water, and you can get a maximum energy credit of $300.

Propane Boilers Exactly the same as a gas boiler, but propane is used instead of natural gas. Propane is more expensive, but it is generally available wherever you live. Again, this is still using fossil fuel, so isn’t good for the environment.

However, for a new energy-efficient propane boiler, you can get a maximum energy credit of $150.

Propane Furnaces The same as a gas furnace, but propane is used instead of natural gas. Propane is expensive but readily available. Again, this is a fossil fuel so not eco-friendly, but you can get a maximum energy credit of $150 for a new energy-efficient furnace.

Propane Heat Pump Water Heaters These work in the same way as gas or electric heat pump water heaters except propane is used to power the pump – as we’ve talked about above, an electric pump is the best choice for the environment.

Still, upgrading to an energy-efficient water pump has a maximum credit of $150.

Energy-Efficient Doors Exterior doors of a home are responsible for a significant amount of air leakage, so it is important to replace your exterior doors with new models for better energy efficiency. These new doors will have weather-stripping that seals potential air leaks. Old glass or patio doors are particularly inefficient, so it is beneficial to invest in new ones if you can.

You can receive a maximum energy credit of $500 toward your new doors (installation not included).

Energy-Efficient Skylights As you’ll know if you have one, old skylights are terrible for being a source of heat in the summer and freezing temperatures in the winter. New skylights are made with more energy-efficient technologies, such as heat-absorbing tints and insulated glazing, to reduce these temperature changes.

If you’re ready to upgrade, you can receive an energy credit of up to $500 (installation not included).

Energy-Efficient Windows Inefficient windows contribute to more energy being needed for heating or cooling the home, due to draughts or air escaping. Replacing your old windows or updating your existing windows with weather-stripping and treatments can significantly increase the energy efficiency of your home and severely reduce energy bills.

You can get a maximum energy credit of $200 for new energy-efficient windows (installation costs not included).

Insulation Having good insulation is key to ensuring you keep your heat inside in the winter and cold air in the summer. When your insulation isn’t working effectively, your heating and cooling systems have to work twice as hard, driving up your energy consumption.

You can get an energy credit of up to $500 to help with the costs of replacing your old and inefficient insulation.

Metal or Asphalt Roofs Installing a metal roof can help to significantly lower your energy bills in the summer months as its reflective surface causes heat to “bounce back” rather than being absorbed into your home, which often happens with more traditional roofing materials. This results in your cooling system needing to work harder and use more power.

You can get a maximum energy credit of $500 or metal or asphalt roofing.

Residential Energy-Efficient Property Credit

To qualify for a home improvement tax credit, there are several energy-efficient systems that you can add to your residential property:

Switch and Earn $25 for Every Friend When you switch to Inspire, not only will you be helping to increase the effort towards abolishing the use of fossil fuels in the fight against climate change, every time you refer a friend to Inspire, you and your friend will receive a credit of $25!

Solar Water Heaters Solar water heaters are a particularly cost-effective method of heating your water, and best of all, they use a free source of energy… sunlight! The solar water heater works to preheat water before it is fed into your conventional water heater so that less energy is needed to heat it up to the desired temperature.

The solar water heating tax credit allows you to get 26% of the full cost (system and installation) in 2020, although this rate is being reduced to 22% in 2021.

To qualify for solar water heating tax credit:

- The heater must be installed in the home in which you reside

- At least half of the generated energy needs to come from the sun

- You can only claim for the solar water heating system itself, not your entire system

- Cannot be claimed for expenses relating to swimming pools or hot tubs, only the water used in the dwelling

PV Solar Panels Photovoltaic solar panels are a very popular method of utilizing renewable energy, often placed on rooftops of residential homes. Using sunlight to produce electricity is a super clean form of energy and helps to reduce negative impacts on the environment.

The solar tax credit allows you to get 26% of the full cost (system and installation) in 2020, although this rate is being reduced to 22% in 2021.

To qualify for the solar tax credit you must meet the same criteria as above.

Solar Tax Credit The solar tax credit allows you to get 26% of the full cost (system and installation) in 2020, although this rate is being reduced to 22% in 2021. The same qualifications above apply.

Wind Energy Wind energy is another renewable energy system that can provide you with clean energy at home, saving you anything from 50-90% of your usual energy bill. Wind causes the turbines to spin, and they convert the kinetic energy into electricity.

The wind energy tax credit allows you to get 26% of the full cost (system and installation) in 2020, although this rate is being reduced to 22% in 2021.

To qualify for wind energy tax credit:

- No more than 100 kilowatts of electricity must be generated

- The system does not have to serve the taxpayer’s residence – can be a second home, but you will need to install the wind turbine to claim the credit

- Pair a new wind turbine with unlimited clean energy from Inspire to switch completely to renewable energy:

What qualifies as a home improvement for a tax credit?

Solar electricity systems, solar water heaters, small wind turbines, and geothermal heat pumps all qualify as a home improvement for a tax credit.

How does the federal solar tax credit work?

The federal solar tax credit applies to solar electric systems and solar water heaters. It is currently set at 26% of the total cost of installation, but in 2021 this rate is being reduced to 22%. From 2022 this tax credit will no longer be available for homeowners, but commercial system owners will still be able to claim 10%.

Are there incentives for making your home energy efficient by installing alternative energy equipment?

Several states give tax incentives to improve energy efficiency using alternative energies. Some local utilities also give out incentives in the form of rebates for energy-efficient appliances, equipment, and building materials.

Is a roof eligible for the residential energy efficient property tax credit?

Generally, roofs made from traditional materials are not eligible for a tax credit, including the roof itself and the rafters. However, if you use roofing materials that serve as collectors for solar energy as well as for structure, you may qualify for a tax credit.

What improvements qualify for the residential energy property credit for homeowners?

Energy-efficient improvements that qualify for a credit include:

- windows, skylights, and exterior doors

- metal and asphalt roofs

- insulation

- heating and cooling systems

- water heaters

- biomass stoves

Who qualifies to claim a residential energy property credit?

You may qualify for a residential energy property credit if you make energy-efficient home improvements within a taxable year. This credit is non-refundable, which means that taxpayers can lower their tax liability to zero but no lower.

With energy-efficient tax credits, making environmentally friendly changes to your home is now more affordable than ever, and you can rest well in the knowledge that you are helping in the fight to have a more sustainable planet.

Of course, if it’s still out of reach to purchase new appliances or energy-proof your home, the best way to make a positive change is by becoming an Inspire member. Our members choose completely clean, renewable energy, which is the best way to stop contributing to climate change today.

Don't worry about climate change— do something about it.

Our clean energy plans are the easiest way to reduce your home's carbon footprint.

Switch to clean energy

Inspire Clean Energy

We're on a mission to transform the way people access clean energy and accelerate a net-zero carbon future.

Learn more about Inspire →Explore more

Recent Posts

Top Articles